Introduction

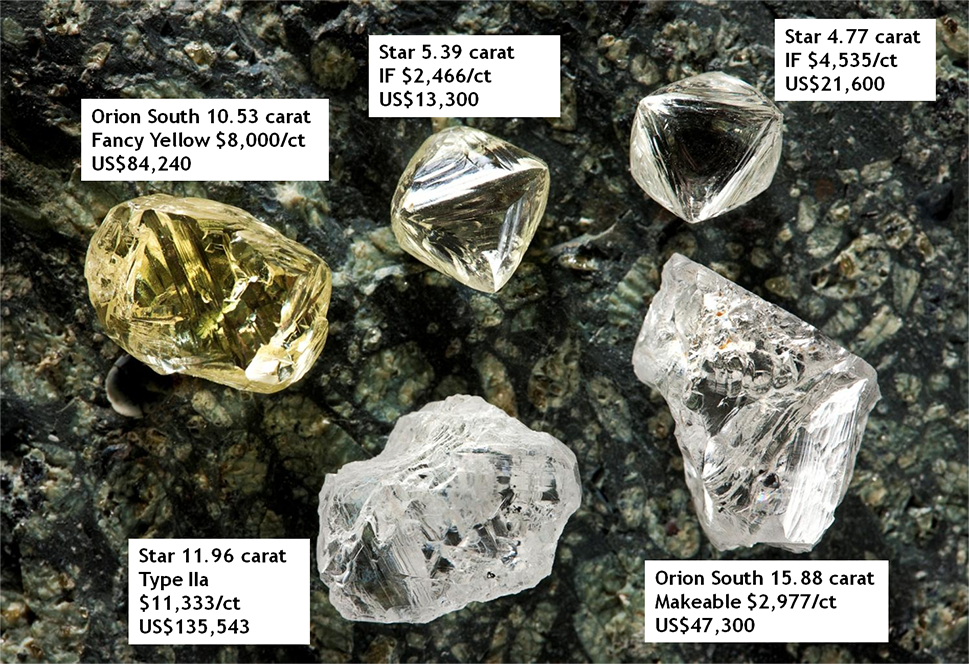

Star – Orion South Diamond Project High Value Stones

Highlights

Star Diamond Corporation currently holds, a 100% interest in certain Fort à la Corne mineral dispositions (including the Star-Orion South Diamond Project).

During 2018, the Saskatchewan Ministry of Environment (“Ministry”) approved the Corporation’s Star - Orion South Diamond Project (“the Project”) under The Environmental Assessment Act (see News Release dated October 25, 2018). The Ministry indicated that they have conducted a thorough environmental assessment for the Project, including a detailed environmental impact statement, and carried out in-depth consultation prior to the decision to approve the Project. This included fulfilling the Province’s duty to consult with local First Nations and Métis communities. The Canadian Environment Assessment Agency previously announced a positive federal Environmental Assessment Decision for the Project (see News Release dated December 3, 2014). The Federal and Provincial EIS approvals require amendment and updating to comply with recent regulatory changes.

During 2018, Star Diamond Corporation announced the positive results of the independent Preliminary Economic Assessment (“PEA”) on the Star and Orion South Kimberlites (see Star Diamond Corporation News Release dated April 16, 2018 and Technical Report dated May 30, 2018). The PEA estimated that 66 million carats of diamonds could be recovered in a surface mine over a 38-year Project life, with a Net Present Value (“NPV”) (7%) of $2.0 billion after tax, an Internal Rate of Return (“IRR”) of 19% and an after-tax payback period of 3.4 years after the commencement of diamond production.

The PEA Highlights Include 1:

- Total potential plant feed of 470 million tonnes at a weighted average grade of 14 carats per hundred tonnes (“cpht”), containing 66 million carats over the 34 year Life of Mine 2. (“LOM”);

- The Base Case scenario (Model diamond price) has an NPV (7%) of $3.3 billion and an IRR of 22% before taxes and royalties, and an after-taxes and royalties NPV (7%) of $2.0 billion with an IRR of 19%;

- The Case 1 scenario (High Model diamond price) has an NPV (7%) of $5.4 billion for an IRR of 32% before taxes and royalties;

- Pre-production capital cost of $1.41 billion with a total capital cost of $1.87 billion (including direct, indirect costs and contingency) over the LOM and an initial capital cost payback period of 3.4 years.

The PEA was led by independent mining, processing and design consultants, with support from the Star Diamond technical team. The principal consultants include: SGS Canada Inc. - Geostat (“SGS”); DRA Americas Inc. (“DRA”) and ENGCOMP Engineering and Computing Professionals Inc. (“ENGCOMP”). A number of other independent consulting firms and potential vendors also provided their study results to Star Diamond for use in developing the PEA. All currency amounts are quoted in Canadian Dollars, unless otherwise stated.

The PEA is based on the Revised Mineral Resource Estimate as documented in the NI 43-101 Technical Report: Technical Report and Revised Resource Estimate for the Star – Orion South Diamond Project Fort a La Corne area, Saskatchewan, Canada December 21, 2015 3.

2018 PEA is based on the historic 2015 Mineral Resources Estimate (MRE). This PEA remains a valid NI43-101 Project metric. The future PFS (2025) will update these values using the stronger 2024 MRE.

1. Cautionary note: The PEA was prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101"). Readers are cautioned that the PEA is preliminary in nature and includes the use of Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the results of the PEA will be realized.

2. Diamond-bearing kimberlite is produced from the mine and diamonds are recovered in the processing plant for 34 years. The overall project life is 38 years, which includes just over four years of pre-stripping activities.

3. During the fourth quarter of 2015, the Company announced Revised Mineral Resource estimates for the Star and Orion South Kimberlites (see Star Diamond Corporation News Release dated November 9, 2015 and Technical Report filed December 21, 2015). Accordingly, the mineral resources and economic assessment previously disclosed by Star Diamond Corporation for the Project should no longer be relied upon.

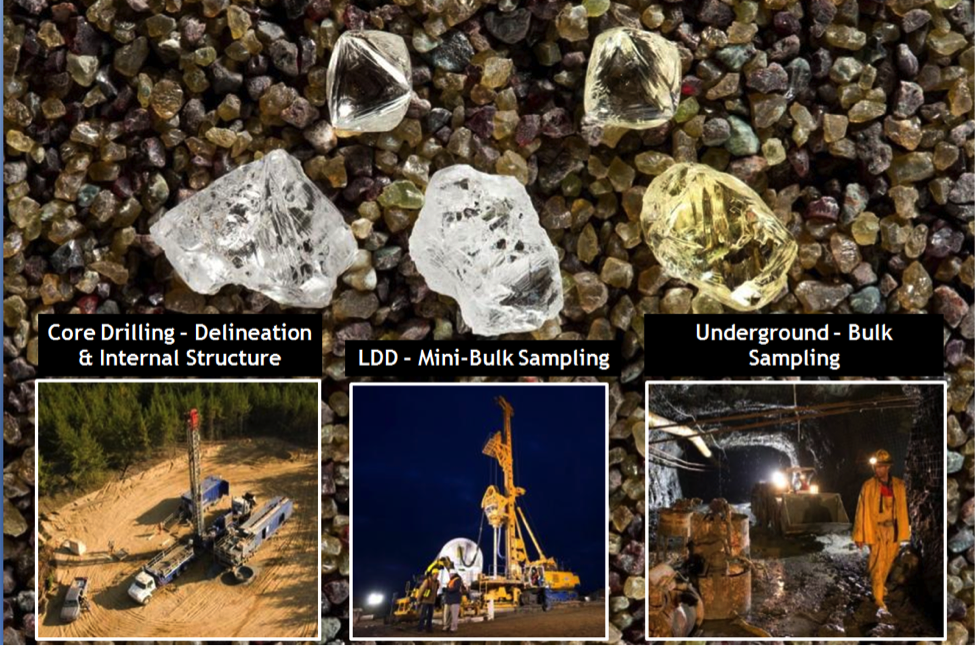

In June 2017 DIAM entered into an Option to Joint Venture Agreement with Rio Tinto Exploration Canada (“RTEC”). The Option Agreement evolved into a 75:25 Joint Venture Agreement between RTEC and DIAM in December 2021. During 2019, RTEC completed a ten-hole bulk sample program on the Star Kimberlite using a Trench Cutter Sampling Rig. Results from this bulk sampling program validate the grades previously stated by DIAM, which were based upon Star Diamond’s own prior underground bulk sampling and large diameter drilling programs.

Revised Mineral Resources Estimate 2024

On, July 24, 2024 – Star Diamond Corporation announced a significant increase in the estimated Mineral Resources for the Star - Orion South Diamond Project (the “Project”).

Highlights

- Indicated Mineral Resources on Star have increased 22 percent to 34.8 million carats and the grade has increased 20 percent to 19.4 cpht

- Indicated Mineral Resources on Orion South have increased 37 percent to 36.9 million carats and the grade has increased 32 percent to 17.9 cpht

- Star Diamond has determined that no additional bulk sampling is required on the Orion South Kimberlite for the rigorous estimation of these Mineral Resources, and this results in the savings of millions of dollars in exploration expenditures and shaves significant time off the completion of the Pre-Feasibility Study (“PFS”).

Revised Mineral Resources Estimate

Table 1. Revised Mineral Resources Estimates for the Star and Orion South Kimberlites

| Star Kimberlite Revised Mineral Resources Estimate |

Orion South Kimberlite Revised Mineral Resources Estimate |

|||||||||

| Resource Category | Kimberlite Unit | Tonnes x1,000 | Grade cpht | Carats x1,000 | Resource Category | Kimberlite Unit | Tonnes x1,000 | Grade cpht | Carats x1,000 | |

| Indicated | MJF | 21,822 | 6.6 | 1,437 | Indicated | EJF Outer | 46,673 | 16.3 | 7,593 | |

| Indicated | EJF Outer | 47,659 | 16.9 | 8,045 | Indicated | EJF Inner | 94,177 | 25.7 | 24,219 | |

| Indicated | EJF Inner | 84,090 | 24.0 | 20,168 | Indicated | Pense | 65,746 | 7.8 | 5,125 | |

| Indicated | Pense | 13,960 | 18.1 | 2,525 | Indicated | TOTAL | 206,596 | 17.9 | 36,937 | |

| Indicated | Cantuar | 12,060 | 21.7 | 2,622 | Inferred | EJF Outer | 41,236 | 15.5 | 6,400 | |

| Indicated | TOTAL | 179,591 | 19.4 | 34,797 | Inferred | Pense | 2,591 | 7.5 | 194 | |

| Inferred | EJF Outer | 34,100 | 14.4 | 4,923 | Inferred | P3 | 6,093 | 12.2 | 742 | |

| Inferred | Pense | 9,982 | 17.6 | 1,761 | Inferred | TOTAL | 49,921 | 14.7 | 7,336 | |

| Inferred | Cantuar | 5,488 | 21.0 | 1,154 | ||||||

| Inferred | TOTAL | 49,570 | 15.8 | 7,838 | ||||||

Table Notes Apply to Table 1

- Canadian Institute of Mining and Metallurgy (“CIM”) definitions were followed for classification of mineral resources.

- Star Kimberlite Units: Cantuar, Pense, Early Joli Fou (“EJF”), & Mid Joli Fou (“MJF”).

- Orion South Kimberlite Units: P3, Pense & Early Joli Fou (EJF).

- Mineral Resources are constrained within a Whittle optimized pit shell.

- Mineral Resources, which are not Mineral Reserves do not have demonstrated economic viability. The estimation of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing or other relevant issues.

- There is no guarantee that all or any part of the Mineral Resources will be converted into a Mineral Reserves.

- Grade values are rounded to the first decimal.

- The effective date of the Revised Mineral Resources estimate is July 24, 2024.

- The EJF Inner and Outer kimberlite units for both deposits are based on detailed kimberlite geology recorded from the core logging of the pattern drilling program. The EJF Inner represents coarser grained EJF kimberlite that occurs within the volcanic crater and the EJF Outer includes finer grained EJF kimberlite that lies on and outside the crater rim. This Revised Mineral Resources estimate acknowledges that the transition from Inner to Outer is geologically gradational.

Attractive evaluation diamond parcel

- Coarse diamond size frequency distribution: 49.5 ct stone from Star, 45.9 ct stone from Orion South

- Significant proportion high value Type IIa diamonds: 11.96c ct stone valued at US$12,500 per carat

Summary

The Project is located in central Saskatchewan some 60 kilometres east of the city of Prince Albert. The Project is in close proximity to established infrastructure, including paved highways and the electrical power grid, which provide significant advantages for future mine development.

Star – Orion South Diamond Project Evaluation

North Aerial View of the Star-Orion South Diamond Project